This content is copyright to www.artemis.bm and should not appear anywhere else, or an infringement has occurred.

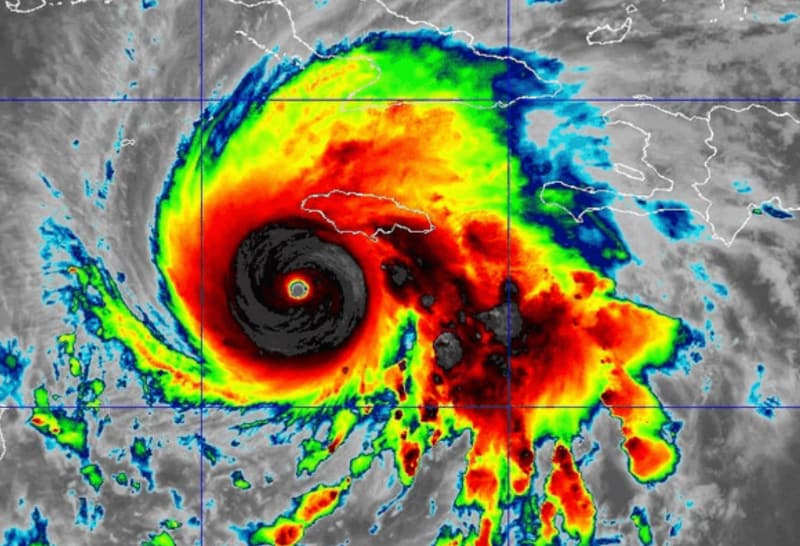

Hurricane Melissa is only estimated to have caused insured losses in a range from US $1 billion to US $2.5 billion in Jamaica, according to catastrophe modeller Cotality, with the total expected pegged at US $1.5 billion, while the economic impacts are far higher demonstrating the protection gap.

Cotality said that total property damage in Jamaica from major hurricane Melissa is estimated to fall between US $5 billion to $9 billion, once the perils of wind, surge, and flooding are combined.

Cotality said that total property damage in Jamaica from major hurricane Melissa is estimated to fall between US $5 billion to $9 billion, once the perils of wind, surge, and flooding are combined.

This compares to a preliminary estimate given by Jamaica’s Prime Minister Dr.Andrew Holness yesterday, who said the damage from the hurricane is expected to be between US $6 billion and US $7 billion.

Putting that into context, Holness said this equates to around 30% of the country’s GDP.

Cotality said, “Persistent protection gaps remain: household and small-business insurance penetration is thought to be 5 to 20 percent, while coverage for large hotels, utilities and airports reaches 80 to 100 percent.”

The catastrophe modelling firm also said, “The losses do not include automobile infrastructure, offshore marine, inland marine, and losses to other islands. Local insurers cede the majority of catastrophe risk, so reinsurers are expected to absorb most of the payout.

“Melissa’s physical damage may ultimately rival or exceed the inflation-adjusted toll of 1988’s Hurricane Gilbert (today gauged at $4 to 6 billion for insurable damage). Yet the outcome could have been far worse. Forecasts 72 hours before Melissa’s landfall showed a credible risk of the core of extreme winds crossing Kingston and St. Catherine, Jamaica’s most densely populated counties.

“A track merely 65 miles farther east of Melissa’s landfall location would likely have driven total property damage to US $25 to 50 billion and insured losses to US $5 to 12.5 billion, potentially straining local insurer solvency and creating an unprecedented humanitarian crisis. A direct hit on Kingston would have represented a significantly more catastrophic event, vastly surpassing the country’s 250-year OEP.”

Cotality’s estimate for insured losses from hurricane Melissa can be compared to one from Verisk’s Extreme Event Solutions division, which said that insured industry losses to onshore property in Jamaica from Hurricane Melissa will likely range between $2.2 billion and $4.2 billion.

In addition, broker Aon said that Melissa’s impacts on Jamaica are likely to drive economic and insured losses into the single-digit billions of dollars, with the potential to rise further as additional damage assessments are completed.

With economic damages caused by hurricane Melissa expected to be far higher than the insurance impact, the support provided by its parametric insurance from the CCRIF SPC and the expected payout of Jamaica’s catastrophe bond will be critical financing to aid in recovery from the storm.

The cat bond payout is still awaiting final confirmation, we understand, but as we reported the World Bank itself had said this was deemed likely.

Prime Minister Holness explained yesterday how the large economic impact will affect Jamaica’s economy, saying, “We anticipate a rise in the debt-to-GDP ratio in the short to medium-term as resources are channeled into rebuilding and resilience. Yet, Jamaica’s record of disciplined fiscal management provides the credibility and space to respond decisively. The sacrifices that we have made and how this Government would have administered our fiscal affairs would have put us in the best position that this country would have ever been to respond to a disaster.”

He added that, “We are already activating the fiscal and financial instruments available to us and engaging our international development partners to support the recovery efforts. Cash flow support to households, emergency social programmes, conciliation financing, targeted industrial assistance will form part of a responsible and discipline economic response.”

Responsive disaster insurance and risk transfer, from the parametric covers including the catastrophe bond, will be a meaningful support as Jamaica recovers.

Also read for more news on Jamaica’s catastrophe bond:

– Hurricane Melissa crosses Jamaica cat bond parametric boxes at 892mb, 100% payout likely.

– Hurricane Melissa losses in Jamaica likely to fall to reinsurers, says AM Best. BMS suggests $5bn+.

– Melissa insured impacts in the billions. Jamaica cat bond full loss most likely: Twelve Securis.

– Jamaica’s cat bond “doing what it was designed to do” – Lefferdink, Aon Securities.

– Hurricane Melissa estimated single-digit billion insured loss. Cat bond payout likely: Aon.

– Jamaica cat bond marked near zero after Melissa landfall. Calculation process underway.

– World Bank says Jamaica catastrophe bond payout “likely” for hurricane Melissa

– No adverse ILS market reaction expected from Melissa cat bond payout: Fitch

Hurricane Melissa insured loss up to $2.5bn, says Cotality. Jamaica’s PM highlights protection gap was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.