This content is copyright to www.artemis.bm and should not appear anywhere else, or an infringement has occurred.

In the weekly Impact Forecasting report from Aon, the company said that major hurricane Melissa’s impacts on Jamaica are likely to drive economic and insured losses into the single-digit billions of dollars, while also confirming parametric structures are likely to respond due to the storms severity.

The insurance and reinsurance broker explained that, for Jamaica, there will be a range of financial instruments that respond, from the government’s own prudent reserves, to contingent capital and the World Bank and IBRD issued catastrophe bond.

The insurance and reinsurance broker explained that, for Jamaica, there will be a range of financial instruments that respond, from the government’s own prudent reserves, to contingent capital and the World Bank and IBRD issued catastrophe bond.

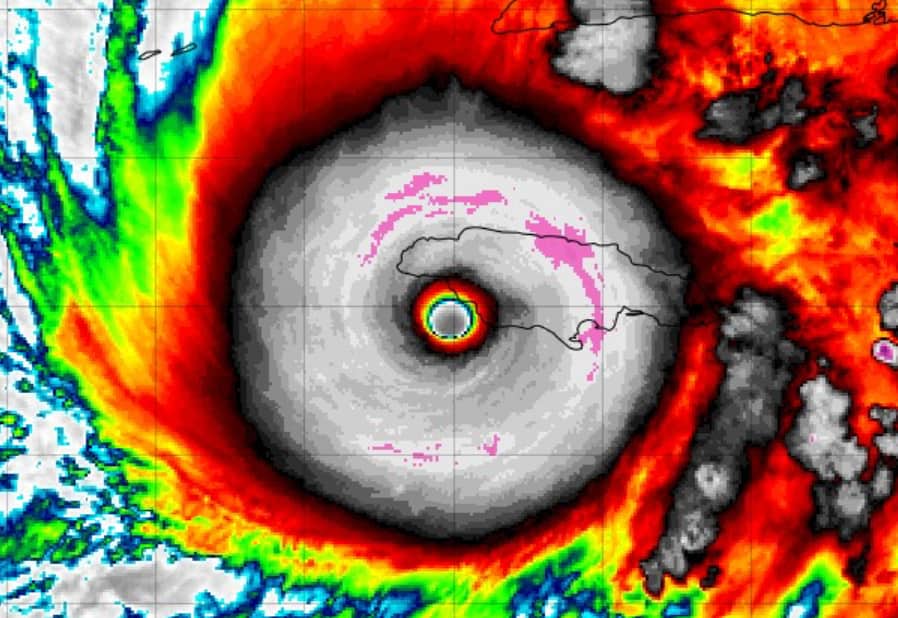

“Under the bond terms, a 100% payout of $150 million is triggered for a hurricane near or directly over Jamaica with a minimum central pressure at or below 900 mb. Given that Melissa achieved a preliminary 892 mb central pressure at landfall, it is likely that the full payout will be triggered, subject to an independent review,” Aon’s report explained.

While adding on other parametric insurance, “Additional payouts are possible due to the country’s relationship with the Caribbean Risk Insurance Facility (CCRIF SPC), which features excess rainfall and wind parametric triggers.”

Aon also provided some helpful details on insurance penetration in Jamaica, which is deemed fairly low.

The broker said, “Looking at the general insurance market, much of Jamaica exhibits very low insurance take-up rates, including the most affected communities on the island’s western half. In 2025, a campaign spearheaded by the Insurance Association of Jamaica (IAJ) noted that only 20% of residential properties nationwide are insured, of which around 95% are considered underinsured. Additionally, a recent report from AM Best found that only 5% of all properties in Jamaica were covered by insurance. However, compared to impacts from Hurricane Gilbert, Jamaica has seen a large buildup of exposure since 1988, such as resort infrastructure. Amidst these developments, there are fears of significant wind and flood insured losses within the commercial and residential markets. There is also the threat of crop insurance loss, though only around 1,100 small farmers are known to be insured as of 2024 – significantly smaller than the roughly 180,000 total registered farmers.”

Leading Aon to further explain that, “Nevertheless, the catastrophic damage seen thus far to private and public property and infrastructure will generate significant economic losses for Jamaica.

“Given this information, along with additional, extensive damage seen in multiple other Caribbean countries, total economic and insured losses may reach into the single-digit billions of USD. Future damage assessments in the coming weeks and months may drive this aggregated figure even higher.”

Also read:

– Hurricane Melissa crosses Jamaica cat bond parametric boxes at 892mb, 100% payout likely.

– Hurricane Melissa losses in Jamaica likely to fall to reinsurers, says AM Best. BMS suggests $5bn+.

– Melissa insured impacts in the billions. Jamaica cat bond full loss most likely: Twelve Securis.

– Jamaica’s cat bond “doing what it was designed to do” – Lefferdink, Aon Securities.

Hurricane Melissa estimated single-digit billion insured loss. Cat bond payout likely: Aon was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.